2025 Sound Money Legislation Tracker

At Citizens for Sound Money (C4SM), we track the progress of sound money legislation across all 50 states. Our State Sound Money Legislation Tracker provides a real-time overview of where each state stands in recognizing gold and silver as legal tender, removing taxation, and supporting sound money principles.

What This Tracker Includes:

- Gold & Silver as Legal Tender – States that have officially recognized gold and silver as legal currency.

- Active Legislation – States with sound money bills currently filed and under consideration.

- Failed Legislation – States where sound money bills have been introduced but did not pass.

- No Active Legislation – States that currently have no sound money bills filed.

This resource is designed to inform the public, businesses, and legislators about the ongoing efforts to restore sound money policies at the state level.

Check back frequently for updates on legislation status and new bill filings!

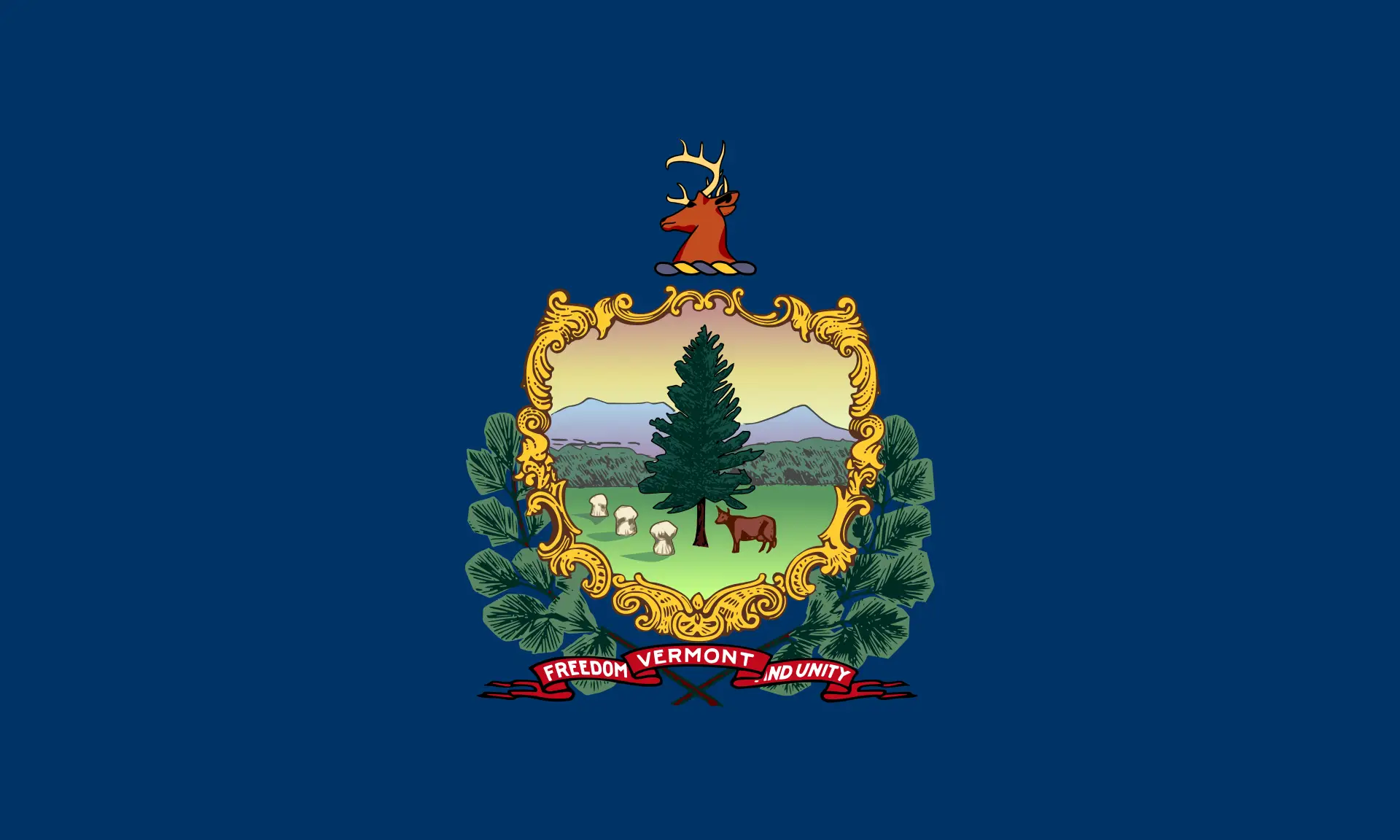

Grey Lettering – No Active Legislation

(27 States)

Green Lettering – Active Legislation

(21 States)

Red Lettering – Failed Legislation

(2 States)

![]() Gold & Silver Legal Tender

Gold & Silver Legal Tender

(6 States)

ALABAMA

ACTIVE LEGISLATION

Alabama is taking steps toward recognizing gold and silver as legal tender with newly introduced legislation.

- Senate Bill 130 (SB130) – Introduced by Sen. Tim Melson, this bill authorizes gold and silver bullion and coins as legal tender within the state.

Status: The House passed SB130, following the Senate’s earlier approval. The legislation now heads to Gov. Kay Ivey for her consideration.

Updated: April 7, 2025

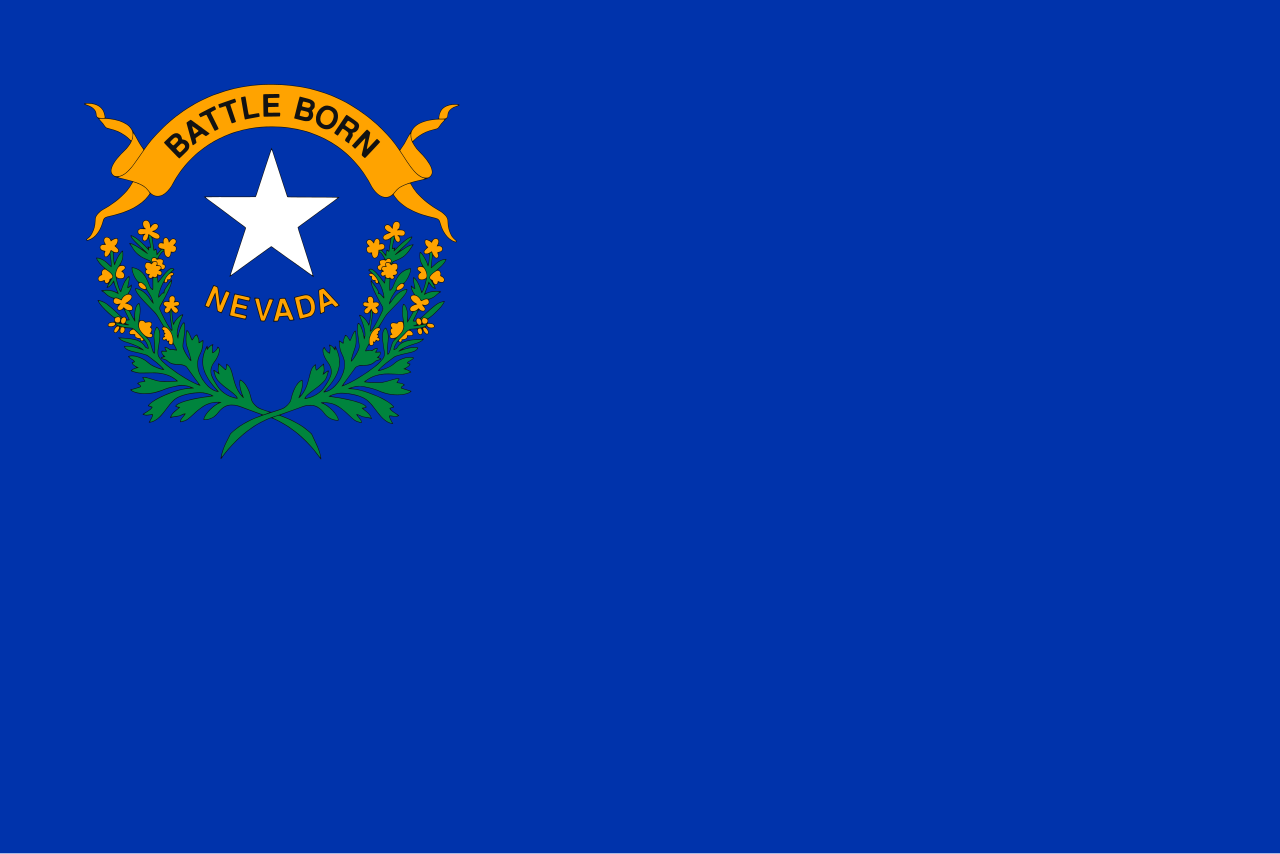

ALASKA

ACTIVE LEGISLATION

Alaska’s efforts to recognize gold and silver as legal tender are now under committee review.

- House Bill 1 (HB1) – Sponsored by Rep. Kevin McCabe and multiple co-sponsors, this bill recognizes gold and silver specie as legal tender.

Status: On May 17, the House State Affairs approved the measure. HB1 now move to the House Finance Committee.

Updated: May 22, 2025

ARIZONA

ACTIVE LEGISLATION

Arizona is advancing legislation to establish a bullion depository, setting the stage for gold- and silver-backed transactional currency.

- Senate Bill 1096 (SB1096) – Sponsored by Sen. Jake Hoffman, this bill establishes the Arizona Bullion Depository to securely store precious metals and support a gold- and silver-backed currency.

Status: The bill has passed the Senate and is now before the House Regulatory Oversight Committee, with a hearing scheduled for March 18 at 2:00 PM.

Arizona passed HB 2014, allowing the use of gold and silver as legal tender and eliminating capital gains taxes on precious metals.

![]()

May 9, 2017

Updated: March 17, 2025

ARKANSAS

no Active Legislation

Arkansas passed HB 1718 recognizing gold and silver as legal tender within the state.

![]()

April 11, 2023

HB1918 was signed into law expanding the state’s legal tender law and clearing the way for payments to and from the state in gold and silver.

April 17, 2025

Updated: April 27, 2025

CONNECTICUT

ACTIVE LEGISLATION

Connecticut’s Senate bill seeks to recognize gold and silver as legal tender, eliminate taxes on their use, and foster competition against the Federal Reserve.

- Senate Bill 1552 (SB1552) – Introduced by House Finance, Revenue and Bonding Committee. Under the proposed law, gold and silver coins issued by the U.S. government, along with gold and silver bullion, would be deemed legal tender in Connecticut.

Status: The bill will move to the Senate for further consideration.

Updated: May 14, 2025

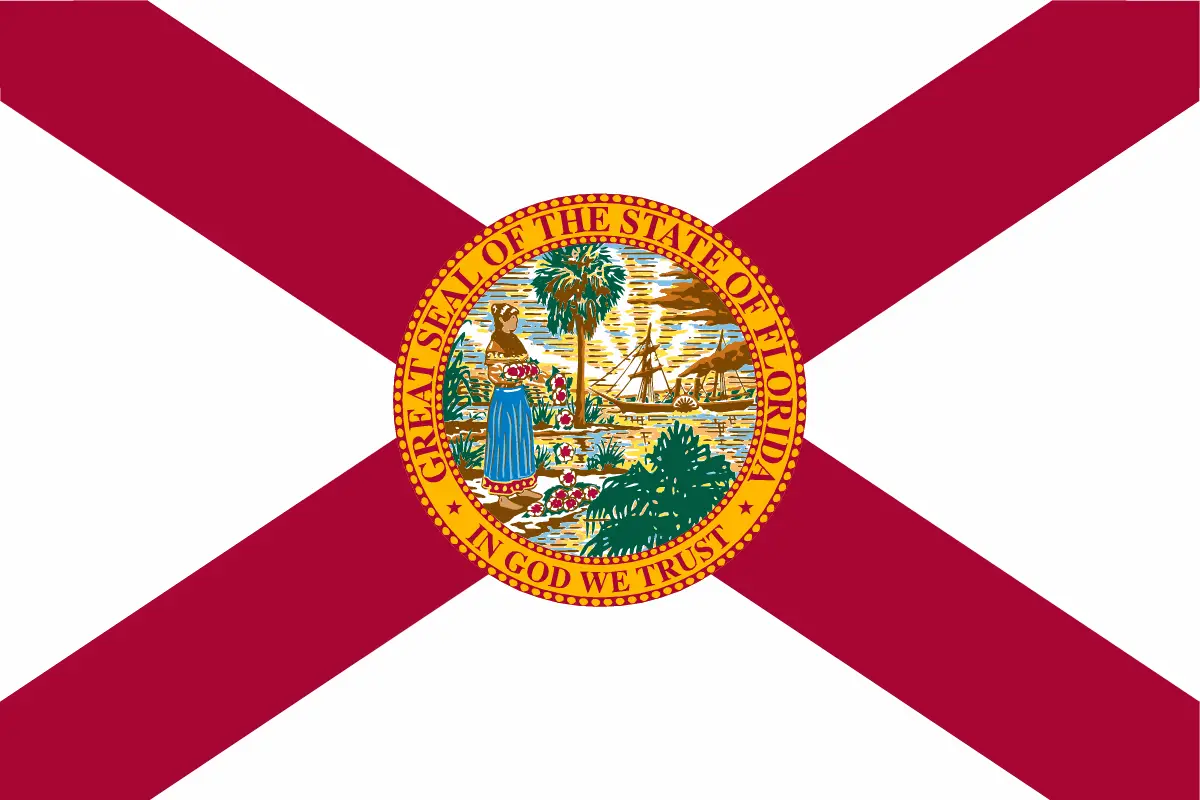

FLORIDA

ACTIVE LEGISLATION

With four major sound money bills introduced, Florida is shaping up to be a battleground state for monetary reform.

Senate Bill 132 (SB132) – Recognizes gold and silver as legal tender and removes taxes on transactions involving these metals.

Senate Bill 134 (SB134) – Exempts the sale of gold, silver, and platinum bullion from the state sales tax.

Status: The Senate Banking and Insurance Committee passed SB134.

- Senate Bill (SB7034) – Exempting the sale of gold, silver, and platinum bullion from the state sales tax.

Status: Indefinitely postponed and withdrawn from consideration.

- House Bill 999 (HB999) – Prevents gold and silver from being classified as taxable personal property and allows government entities to accept them as payment.

Status: On April 30, the House concurred with the Senate amended version in a unanimous 113-0 vote, completing the legislative process and sending the bill to Gov. Ron DeSantis for consideration.

House Bill 6019 (HB6019) – Seeks to repeal the Florida estate tax, potentially affecting the taxation of gold and silver.

Status: The bill have been introduced and await hearing.

- House Bill 7033 (HB7033) – Revises provisions relating to taxation

Status: The bill has been approved by the House and it’s now in the Senate.

Updated: May 14, 2025

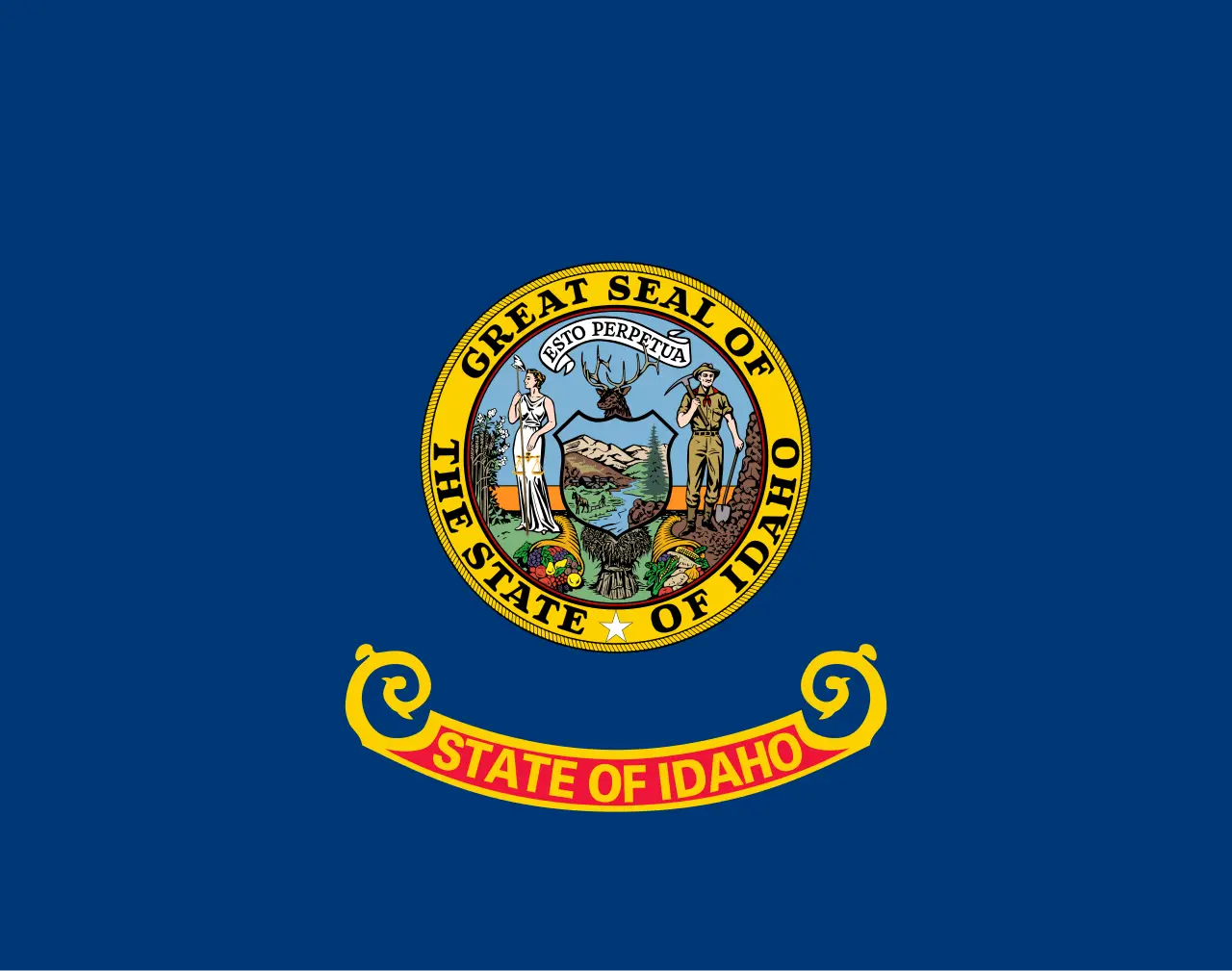

IDAHO

ACTIVE LEGISLATION

Idaho’s latest legislative push aims to ensure gold and silver can be used as legal tender without any mandates on individuals or businesses.

- House Bill 177 (H0177) – Adds to existing law to declare gold and silver coin and specie as legal tender while ensuring no person or entity can be forced to accept them.

Status: The bill has passed the House and is now transmitted to the Senate.

Updated: March 17, 2025

INDIANA

ACTIVE LEGISLATION

Indiana’s legislative focus is on establishing a bullion depository to facilitate precious metals-backed transactions.

- House Bill 1614 (HB1614) – Introduced by Rep. Shane Lindauer, this bill establishes a state-run bullion depository.

Status: Referred to the House Ways and Means Committee.

Updated: March 17, 2025

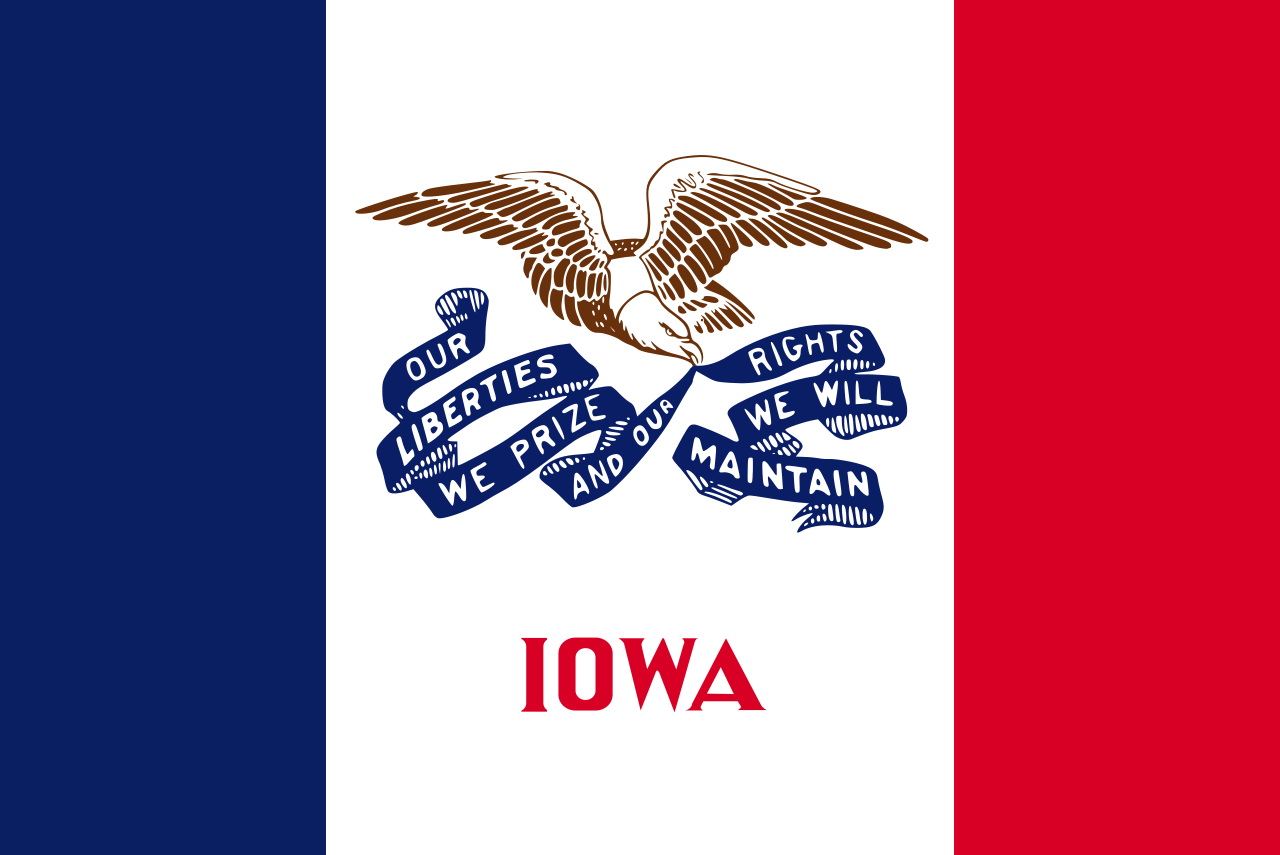

IOWA

ACTIVE LEGISLATION

Iowa’s legislature is considering a gold and silver-backed transactional currency, a bold step toward monetary sovereignty.

- Senate File 112 (SF112) – Proposes creating a gold- and silver-backed currency administered by the State Treasurer.

Status: Under review in the Senate State Government Committee.

Updated: March 17, 2025

KANSAS

ACTIVE LEGISLATION

Kansas is actively considering sound money legislation that would remove taxes on gold and silver and establish a bullion depository.

Senate Bill 39 (SB39) – Establishes the Kansas Legal Tender Act and removes capital gains taxes on precious metals.

Senate Bill 115 (SB115) – Enacts the Kansas Bullion Depository Act, allowing the state treasurer to invest in gold and silver.

Status: The Senate has passed SB39 and will move to the House for further consideration, while SB115 is under review.

Updated: April 7, 2025

KENTUCKY

ACTIVE LEGISLATION

Kentucky is moving forward with a bill to exempt gold and silver from state taxation.

- House Bill 2 (HB2) – Declares an emergency to eliminate taxation on currency and bullion.

Status: The House and Senate overwhelmingly approved the measure but Gov. Beshear vetoed it. The legislature then overrode Beshear’s veto. The Senate approved the override by a 31-6 vote, and the House did so by an 80-19 margin.

Updated: April 7, 2025

LOUISIANA

No active Legislation

Louisiana enacted SB 232, the Louisiana Legal Tender Act, allowing the use of gold and silver coins issued by the U.S. government as legal tender and exempting them from state sales taxes.

![]()

August 1, 2024

Updated: March 17, 2025

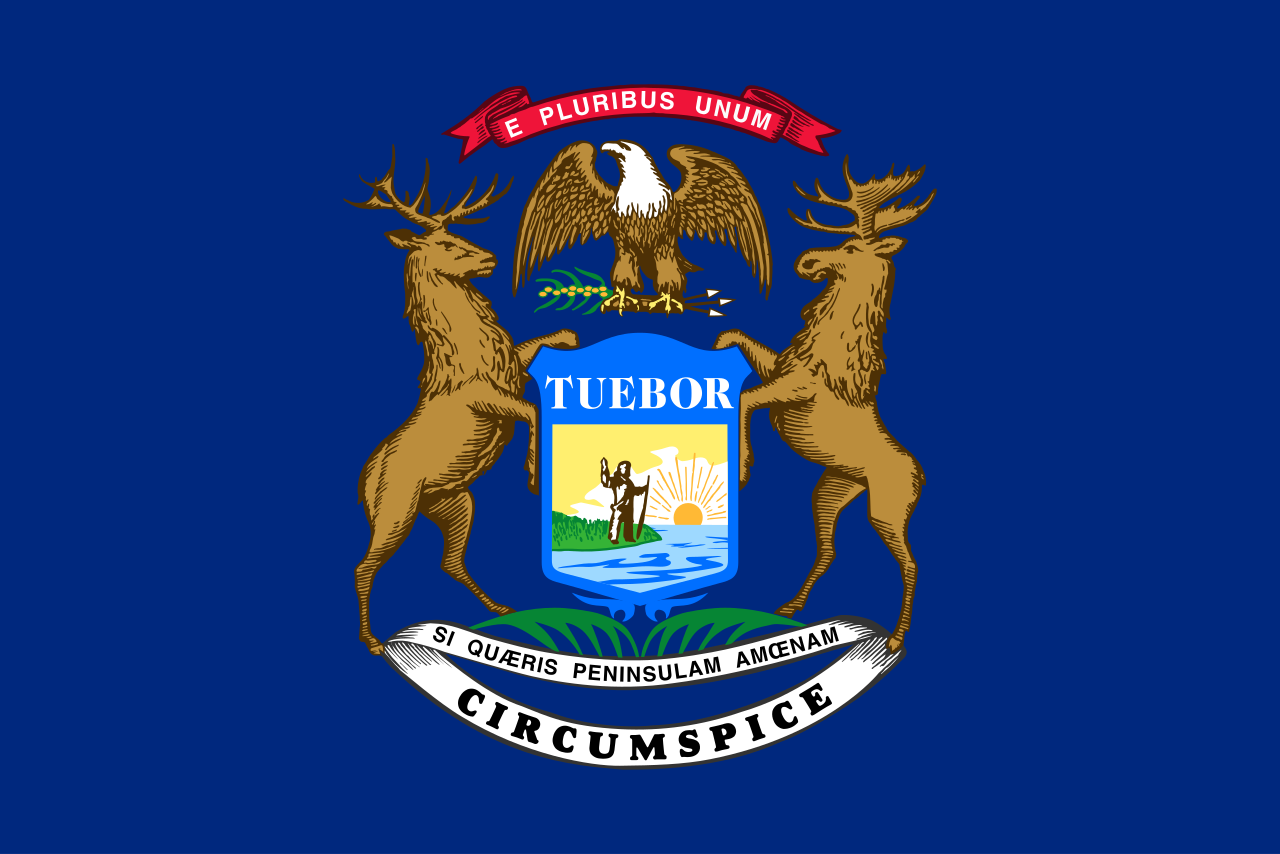

MICHIGAN

ACTIVE LEGISLATION

Michigan is working to establish a state-run bullion depository and introduce a gold-backed currency.

- House Bill 4086 (HB4086) – Creates the Michigan Bullion Depository and Michcoin Act.

Status: Currently in the House Communications and Technology Committe

Updated: March 17, 2025

MISSOURI

ACTIVE LEGISLATION

Missouri lawmakers are advancing several bills aimed at reaffirming gold and silver as legal tender and protecting citizens from financial instability caused by fiat currency devaluation.

- House Bill 754 (HB754) – Would recognize gold and silver as legal tender, exempt both from state capital gains taxation, and bar state enforcement of any federal confiscation scheme.

Status: Has officially PASSED the Missouri House! Now it’s heading to Governor Kehoe’s desk for signature

- House Bill 433 (HB433) – Introduced by Rep. Bill Hardwick, this bill modifies standards for the storage and use of gold and silver, aiming to integrate them into Missouri’s monetary system.

- House Bill 630 (HB630) – Introduced by Rep. Michael Davis, this bill establishes “The Constitutional Money Act,” setting legal standards for using gold and silver as money.

- Senate Bill 25 (SB25) – Introduced by Sen. Mike Moon, this bill proposes recognizing gold and silver as legal tender and eliminating capital gains taxes on their sale.

- Senate Bill 194 (SB194) – Introduced by Sen. Rick Brattin, this bill strengthens protections for gold and silver legal tender and provides additional provisions for its use.

Status: The House bills have passed committee and are advancing, while the Senate bills are currently stalled in the Insurance and Banking Committee, facing opposition from leadership.

Updated: May 14, 2025

MONTANA

LEGISLATION FAILED

Montana lawmakers are moving forward with a bill that would officially recognize gold and silver as legal tender while prohibiting taxation on its use.

- House Bill 382 (HB382) – Known as The Specie Legal Tender Act, this bill was introduced by Rep. Tom Millett and would enshrine gold and silver as legal tender, free from taxation.

Status: The bill failed its second reading in the House but is expected to be reintroduced or amended for further consideration.

Updated: March 17, 2025

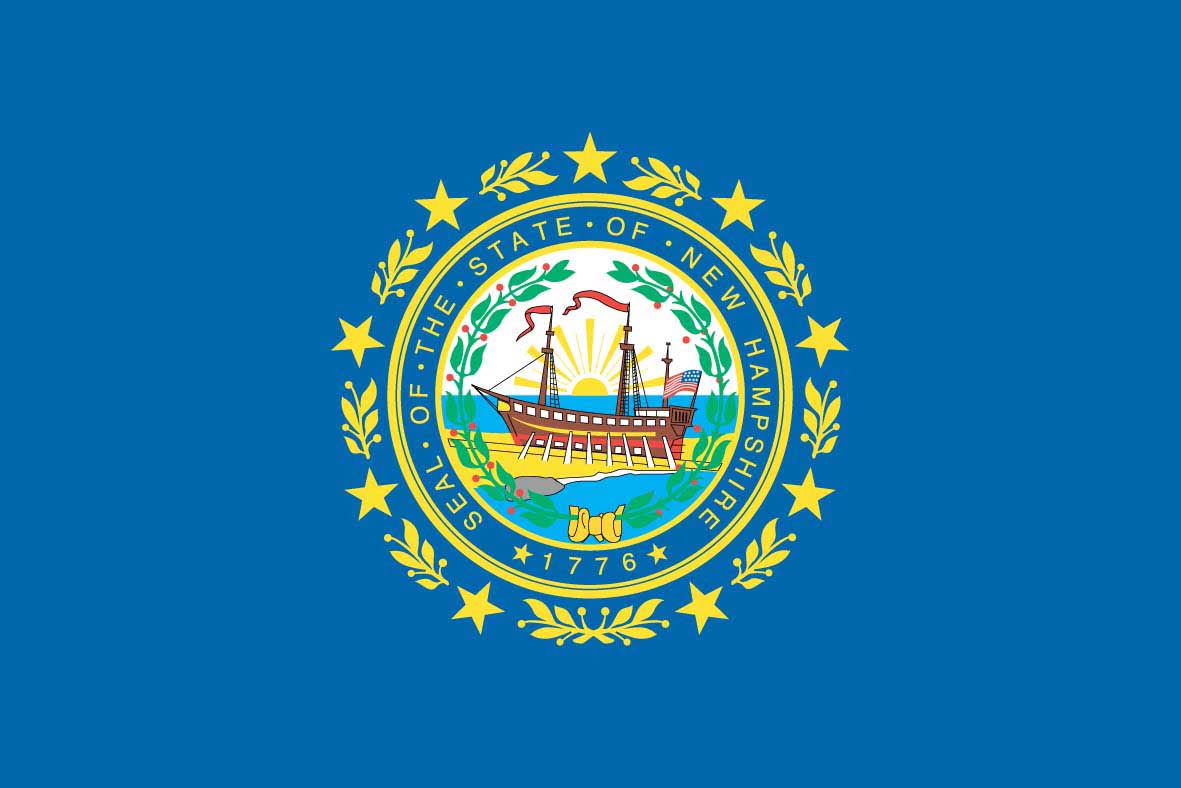

NEW HAMPSHIRE

ACTIVE LEGISLATION

New Hampshire is on the verge of passing a major sound money bill that could set a national precedent. C4SM has provided direct testimony and is engaging with legislators to ensure its passage.

- House Bill 721 (HB721) – This bill, sponsored by Rep. Juliet Harvey-Bolia, officially recognizes gold and silver as legal tender in the state. The bill is currently in the House Commerce and Consumer Affairs Committee, with a hearing scheduled for March 19 at 10:00 AM.

Status: Pending committee review; public testimony has been overwhelmingly supportive.

Updated: March 17, 2025

NORTH CAROLINA

Active Legislation

North Carolina lawmakers are advancing a bill that would officially designate gold and silver as legal tender and eliminate state capital gains taxes on these precious metals.

- House Bill 836 (H836), known as the North Carolina Sound Money Act, was introduced by Rep. Mark Brody along with three cosponsors. If enacted, the bill would enable investment coins and refined gold or silver bullion, clearly marked with their weight and purity, to be recognized as legal tender within the state.

Status: H836 moves to the House Finance Committee.

Updated: May 14, 2025

NORTH DAKOTA

Legislation Failed

North Dakota lawmakers introduced three key sound money bills aimed at protecting gold and silver investments, eliminating taxes on bullion sales, and rejecting central bank digital currencies (CBDCs).

House Bill 1183 (HB1183) – Would authorize the state to invest in gold and silver bullion as part of its reserve assets and require a report on its holdings.

Status: The bill was reported back with a “Do Not Pass” recommendation but was placed on the legislative calendar for further debate.

House Bill 1379 (HB1379) – Proposes eliminating capital gains taxes on gold and silver transactions, ensuring these metals are treated as money rather than taxable assets.

Status: The bill failed on its second reading, but legislators may consider amendments or future reintroduction.

House Bill 1441 (HB1441) – Seeks to reject the implementation of a United States central bank digital currency (CBDC) by excluding it from the legal definition of money under North Dakota law.

Status: Failed in the House, but its rejection highlights growing legislative opposition to federal monetary control mechanisms.

Despite setbacks, North Dakota’s legislative efforts demonstrate strong resistance to federal overreach in monetary policy. C4SM will continue monitoring potential amendments and reintroductions of these bills.

Updated: March 17, 2025

OKLAHOMA

ACTIVE LEGISLATION

Oklahoma lawmakers are advancing multiple sound money bills that would establish a bullion depository, recognize gold and silver as legal tender, and restrict the mandatory use of fiat currency.

House Bill 1197 (HB1197) – Expands the role of the State Treasurer by allowing transactions involving gold and silver bullion, including fee structures for state transactions.

House Bill 1199 (HB1199) – Recognizes gold and silver as legal tender and removes state taxation on precious metal transactions.

Status: The Oklahoma House passed bills HB1197 and HB1199, they will move to the Senate for further consideration.

Senate Bill 33 (SB33) – Establishes the Oklahoma Bullion Depository, providing secure storage for precious metals and facilitating gold- and silver-backed transactions.

Status: Assigned to the Senate Revenue and Taxation Committee.

Senate Bill 284 (SB284) – Would allow public and private debts to be paid in gold and silver while restricting requirements to settle obligations in fiat currency.

Status: Referred to the Senate Revenue and Taxation Committee.

Oklahoma’s bold legislative approach underscores a growing movement to fortify financial sovereignty and reduce dependence on federal monetary policies. C4SM is closely monitoring these bills as they advance through committee hearings.

Oklahoma recognized gold and silver U.S.-minted coins as legal tender and exempted them from state taxation with the signing of SB 862.

![]()

June 4, 2014

Updated: April 7, 2025

TENNESSEE

ACTIVE LEGISLATION

Tennessee lawmakers are considering legislation that would establish a framework for the state to engage in gold and silver transactions, further solidifying its commitment to sound money policies.

- Senate Bill 168 (SB168) – Amends Tennessee Code to authorize the state to engage in transactions using precious metals and establishes guidelines for state-held bullion reserves.

Status: The Senate Commerce and Labor Committee passed SB168, it will move to the Senate Finance Ways and Means Committee.

If passed, Tennessee could join the growing list of states moving toward financial independence from the federal reserve system by incorporating gold and silver into its monetary framework. C4SM will continue to monitor and engage with legislators on this critical bill.

Updated: April 7, 2025

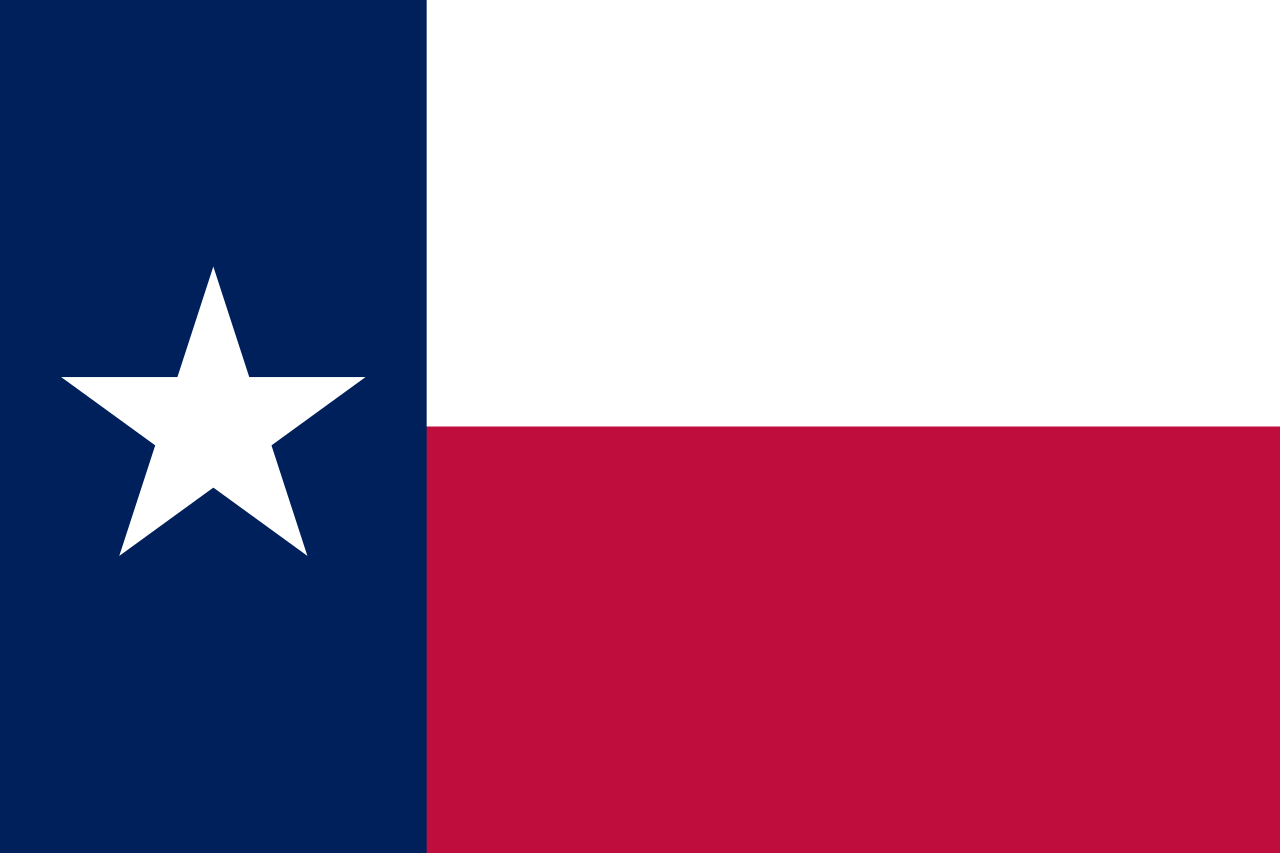

TEXAS

ACTIVE LEGISLATION

Texas has introduced multiple bold sound money bills aimed at establishing gold- and silver-backed currency, expanding state bullion reserves, and enhancing financial sovereignty.

House Bill 1049 (HB1049) – Proposes the issuance of gold and silver specie and the creation of a state-backed currency based on gold and silver reserves.

Status: Assigned to the House State Affairs Committee for review.

House Bill 1056 (HB1056) – Similar to HB1049, this bill establishes gold- and silver-backed currency and provides mechanisms for issuing and redeeming precious metal-backed notes.

Status: Awaiting review in the House State Affairs Committee.

House Bill 1062 (HB1062) – Requires Texas to acquire $4 billion in gold bullion and $1 billion in silver bullion to be stored in the Texas Bullion Depository, ensuring the state has sound money reserves to hedge against economic uncertainty.

Status: Referred to the House Pensions, Investments & Financial Services Committee.

Texas remains at the forefront of the sound money movement, taking a bold and proactive stance to protect financial sovereignty. If passed, these bills would set a precedent for states looking to bypass federal monetary policy and embrace a more stable, asset-backed financial system.

Updated: March 17, 2025

UTAH

ACTIVE LEGISLATION

Utah is on the brink of passing a major sound money bill that would provide gold and silver-backed payment options for state transactions.

- House Bill 306 (HB306) – Introduced by Rep. Ken Ivory, this bill would allow state transactions to be conducted using gold and silver-backed instruments. The bill has passed the House and is now under review in the Senate Revenue and Taxation Committee.

Status: Awaiting a Senate hearing; if passed, Utah could set a major precedent for sound money transactions in state government.

![]()

March 25, 2011

Updated: March 17, 2025

VIRGINIA

ACTIVE LEGISLATION

Virginia is focusing on extending tax exemptions on precious metals, reinforcing the state’s commitment to sound money principles.

- House Bill 2336 (HB2336) – Extends the sales tax exemption on purchases of gold, silver, and platinum bullion, ensuring that precious metals remain free from state taxation.

Status: Referred to the House Finance Committee.

This continuation of Virginia’s tax-free status on gold and silver strengthens incentives for residents to use and invest in sound money, protecting their wealth from inflation and fiat devaluation.

Updated: March 17, 2025

WEST VIRGINIA

ACTIVE LEGISLATION

West Virginia has introduced a groundbreaking bill that would recognize gold, silver, and cryptocurrency as legal tender, establish a state bullion depository, and authorize gold- and silver-backed transactional currency.

House Bill 2463 (HB2463) – Introduced by Del. Chris Anders and seven co-sponsors, this bill recognizes gold and silver bullion and specie as legal tender in West Virginia. Authorizes the creation of the West Virginia Bullion Depository, a state-controlled facility to store precious metals. Allows the depository to issue transactional currency backed by gold and silver, providing an alternative to fiat money.

Status: HB2463 has been referred to the House Finance Committee for further review.

This legislation aligns with the growing national trend of states moving toward financial independence from the federal reserve system. If enacted, West Virginia would join the ranks of states implementing gold- and silver-backed financial instruments to counter inflation and fiat currency devaluation.

C4SM will continue monitoring the bill’s progress and engaging with West Virginia lawmakers to support its passag

Updated: March 17, 2025

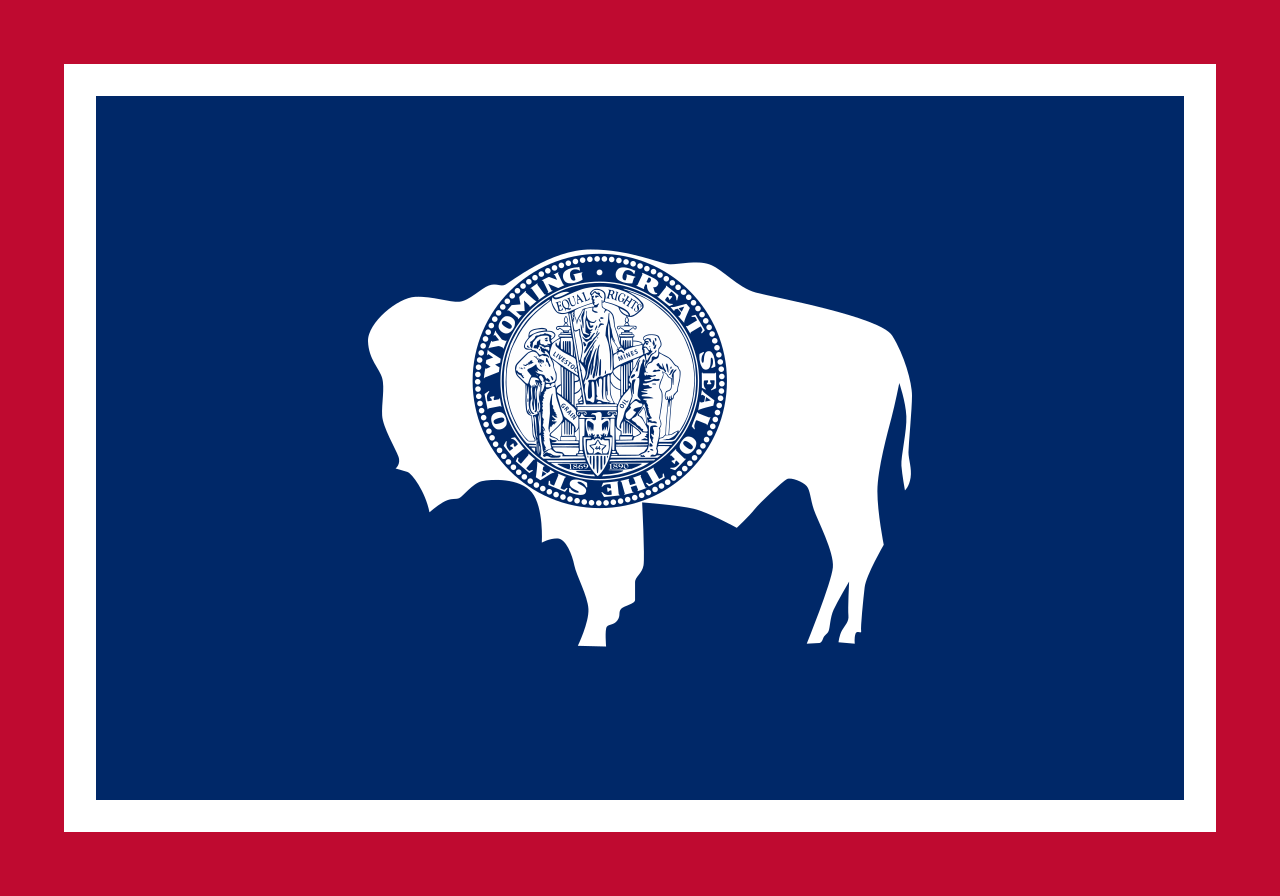

WYOMING

no active legislation

Wyoming has officially passed and enacted its landmark sound money legislation, making it one of the most forward-thinking states on the issue.

- Senate File 96 (SF96) – Known as the Wyoming Gold Act, this law requires the state treasurer to hold at least $10 million in gold and silver as reserve assets. This positions Wyoming as one of the first states to secure its financial reserves with physical precious metals.

Status: SIGNED INTO LAW! Wyoming now joins a growing list of states taking proactive measures to protect against the risks of fiat currency.

Wyoming enacted HB 103, the Wyoming Legal Tender Act, recognizing gold and silver as legal tender and removing all tax liability from their exchange.

![]()

March 8, 2018

Updated: March 17, 2025